Pricing Matters | How do Rising Interest Rates Affect Buyers and Sellers in the Park City Market?

Posted by Negar Chevre on Sunday, August 7th, 2022 at 1:04pm.

Buyers and Sellers alike are asking us about the state of the Greater Park City Real Estate Market. Is it a good time to list? Should we be buying or selling with riding interest rates? Should we wait to buy or sell? Will continued rate hikes and inflation affect the state of the Park City Real Estate Market?

All good questions! Though we are not in the business of predicting the future, we do analyze the date as it relates to the Greater Park City area Real Estate on a weekly basis and present those facts to our clients on a regular basis. It goes without saying that the 2020 to early 2022 housing market in a post pandemic world broke all kids of records, while historic low mortgage rates, a high demand from individuals and families leaving large cities, coupled with new construction not keeping up with market demand going back to 2008 and supply chain challenges, resulted in a heated market to say the least. The end of Q2 2022 however, has seen a re-alignment in the real estate market in the Greater Park City Area and across the nation towards a more balanced market, with higher inventory levels (a 101% increase in inventory from January of 2022 to June of 2022 in the Greater Park City area) and a reduction in the number of transactions and volume sold across our various neighborhoods. It is important to note that even though our inventory levels have steadily increased we are still significantly below our historic levels. Despite the move towards a more balanced market with more choices for buyers, prices in the single family, condo and land markets have remained strong throughout our various neighborhoods. As an example we saw a 35% increase in median prices in Q2 2022 in the Park City Proper Area (median prices now $3.7 Million) and a 22% price increase in median prices of single family homes in Snyderville Basin (median price now $2.132 Million) in comparison to Q2 of 2021.

Here is what we do know on a macro economic level. Based on the data released in July 2022 the US economy has gained back the 22 million jobs that were lost during the pandemic. 528,000 jobs were added in the month of July and the unemployment rate fell to 3.5%. Despite the fact that we have recovered all the jobs lost during the pandemic, there are still 623,000 fewer people in the workforce, pushing wages up. Wage growth in July was stronger than anticipated with hours earnings rising by 0.5% from one and 5.2% from a year ago. Most of the job gains were in the hospitality industry, healthcare, construction, professional and business services areas. Given the wage growth and number of jobs created in just one month, this will make it harder for the Federal Reserve to slow down the rate increases in their next meeting in September as they continue to fight inflation while working towards a soft landing to avoid a recession.

To summarize:

- Interest rates are going up. The federal reserve has committed to halting inflation and in an effort to “cool” the economy, multiple interest rake hikes have been promised

- Forgetting for one moment the price increases in the last two years, the average national home value appreciation over a 10 year period in the United States is 3.8%; in Utah that number is over 5% and in Park City it is closer to 7%

- Despite recent increased in the number of homes hitting the market, the current available inventory (# of properties for sale) is still half of that in the years preceding the global pandemic.

What does that mean?

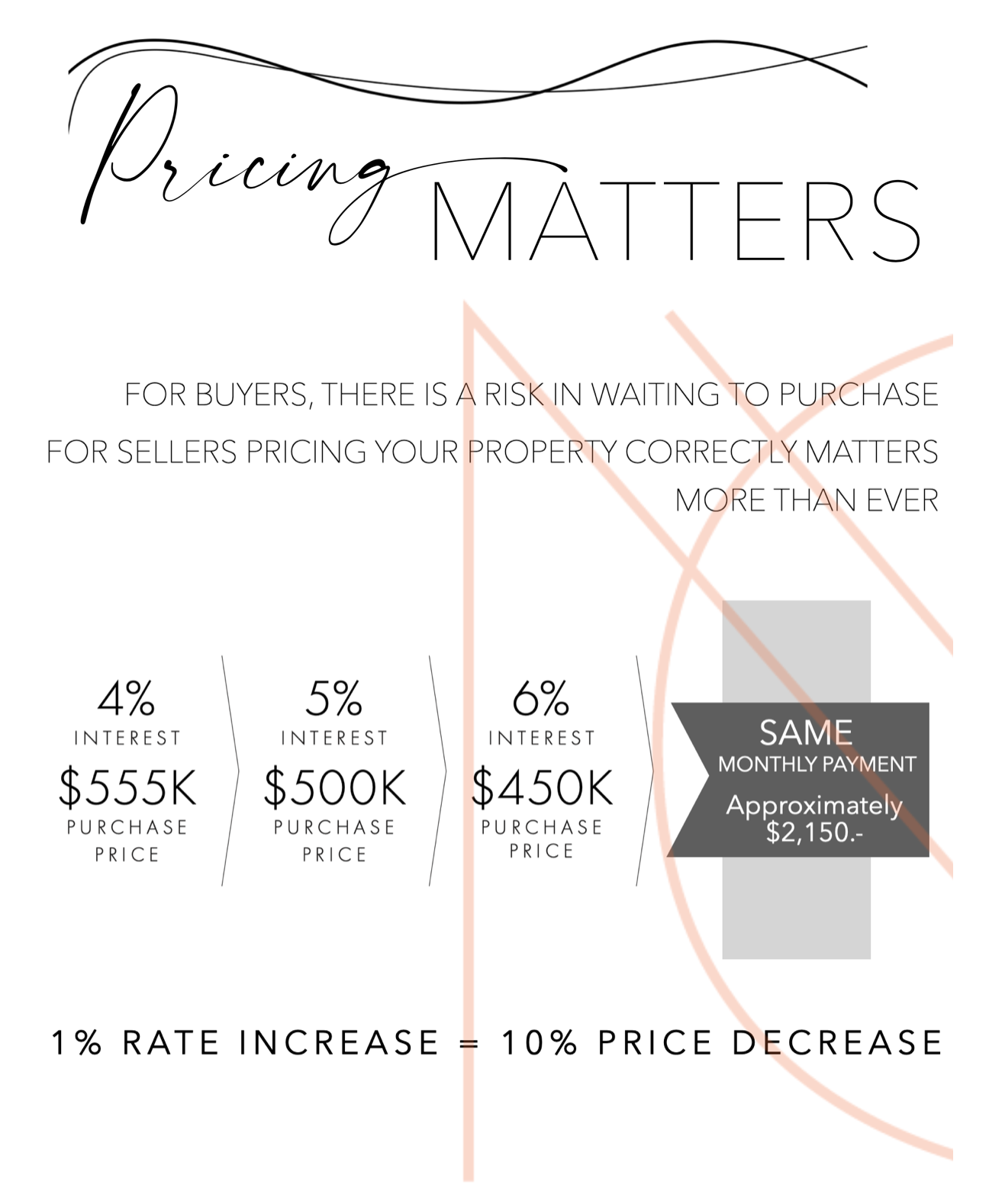

- For Buyers, there is a risk in waiting to purchase as every 1% increase in interest rates is equivalent to a 10% decrease in their purchasing power

- For Sellers, understanding this math equation is crucial to correctly pricing your property in today’s market (not yesterday’s) and working with a professional real estate advisor that can assist you with pricing your property correctly matters more than ever.

We look forward to answering any questions you may have and continuing to be your trusted advisors in a changing market!